After a hurricane, storm or other disaster, you hoped that your property insurance company would honor your claim and pay for your damages. After all, you purchased homeowners insurance with the expectation that, if a catastrophic loss ever occurred, your insurance company would provide for the repair of your property back to its pre-loss condition.

After a hurricane, storm or other disaster, you hoped that your property insurance company would honor your claim and pay for your damages. After all, you purchased homeowners insurance with the expectation that, if a catastrophic loss ever occurred, your insurance company would provide for the repair of your property back to its pre-loss condition.

Homeowners insurance

Hurricane Irma – How to Handle Your Storm Damage Insurance Claim

Now that Hurricane Irma has marched through the entire length of Florida, those affected by the storm must now face perhaps an even more stressful event – the pursuit of a property damage claim against their homeowners insurance company. Although it may take several weeks for property owners to fully realize the damage caused to

Now that Hurricane Irma has marched through the entire length of Florida, those affected by the storm must now face perhaps an even more stressful event – the pursuit of a property damage claim against their homeowners insurance company. Although it may take several weeks for property owners to fully realize the damage caused to …

Hurricane Deductibles – The Debbie Downer of the Storm Claim Process

When dealing with a hurricane or tropical storm, surviving the weather event is often only the beginning of the battle. The insurance company’s constant nit-picking of your claimed losses can drive you bonkers – especially while you are trying to put the rest of your life back together. Then, just when you think you may…

When dealing with a hurricane or tropical storm, surviving the weather event is often only the beginning of the battle. The insurance company’s constant nit-picking of your claimed losses can drive you bonkers – especially while you are trying to put the rest of your life back together. Then, just when you think you may…

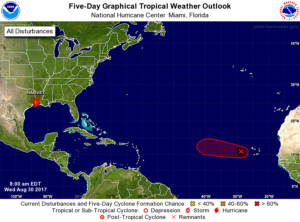

Hurricane Irma – Start Making Storm Preparations Now

Even as the internet is full of Hurricane Harvey damage pictures, another storm is quickly approaching Florida from the eastern Atlantic. Tropical Storm Irma – soon to be Hurricane Irma – is projected to be a major storm and may make landfall along Florida’s coastline. The time is now to stop looking at flood pictures…

Even as the internet is full of Hurricane Harvey damage pictures, another storm is quickly approaching Florida from the eastern Atlantic. Tropical Storm Irma – soon to be Hurricane Irma – is projected to be a major storm and may make landfall along Florida’s coastline. The time is now to stop looking at flood pictures…

Why is the Mortgage Company’s Name on My Insurance Check?

Policyholders are often shocked to learn that the loss settlement check they receive from the insurance company is payable not only to the policyholder, but to their mortgage company as well. Homeowners insurance policies are broken down into several types of coverage – whether for the building, personal property, liability, alternative living expense, or …

Policyholders are often shocked to learn that the loss settlement check they receive from the insurance company is payable not only to the policyholder, but to their mortgage company as well. Homeowners insurance policies are broken down into several types of coverage – whether for the building, personal property, liability, alternative living expense, or …

Is Flood Damage Covered Under My Homeowner’s Insurance Policy?

Most people believe that when they buy homeowner’s or commercial property insurance that they will be covered for any damage that may occur to their property. Unfortunately, as many people have painfully learned during recent flooding events, the normal policy of homeowner’s property insurance does NOT provide coverage for damage caused by “rising water” or…

Most people believe that when they buy homeowner’s or commercial property insurance that they will be covered for any damage that may occur to their property. Unfortunately, as many people have painfully learned during recent flooding events, the normal policy of homeowner’s property insurance does NOT provide coverage for damage caused by “rising water” or…

How to Determine Whether Your Property Has Been Damaged By Vibration from Adjacent Construction.

Developers and construction firms often elect to use heavy equipment, blasting or pile driving in the performance of their construction projects. If your property is in close proximity to a construction project where heavy equipment, pile driving or blasting is being used, your property may incur damage related to the vibration caused by these activities.…

Developers and construction firms often elect to use heavy equipment, blasting or pile driving in the performance of their construction projects. If your property is in close proximity to a construction project where heavy equipment, pile driving or blasting is being used, your property may incur damage related to the vibration caused by these activities.…

Is Vibration Damage Covered Under My Homeowners Property Insurance Policy?

As can be easily witnessed as you drive around town, construction companies often use blasting, pile driving, dewatering and heavy equipment in the performance of large construction projects. Many times, damage can be caused to buildings on nearby properties due to the enormous amount of vibration generated by these activities. The question then becomes whether…

As can be easily witnessed as you drive around town, construction companies often use blasting, pile driving, dewatering and heavy equipment in the performance of large construction projects. Many times, damage can be caused to buildings on nearby properties due to the enormous amount of vibration generated by these activities. The question then becomes whether…

After the Storm – How to Handle the Storm Damage Claim

As Tropical Storm Erika was quickly approaching landfall a few weeks ago, Floridians were correctly focused on preparing for the high winds and water that could have caused an unknown amount of damage. As important as pre-storm preparation is, the steps you take immediately after the storm are also crucial with regard to your ability…

As Tropical Storm Erika was quickly approaching landfall a few weeks ago, Floridians were correctly focused on preparing for the high winds and water that could have caused an unknown amount of damage. As important as pre-storm preparation is, the steps you take immediately after the storm are also crucial with regard to your ability…

Hurricane Danny – Property Insurance Claims on the Horizon

As we watch Hurricane Danny approach the Gulf, it is hard to believe that 10 years have passed since Hurricane Charlie and three other storms caused massive damage and property insurance claims throughout Central Florida. Although the passage of time makes it easy to think that such storm damage is unlikely to happen again, we…

As we watch Hurricane Danny approach the Gulf, it is hard to believe that 10 years have passed since Hurricane Charlie and three other storms caused massive damage and property insurance claims throughout Central Florida. Although the passage of time makes it easy to think that such storm damage is unlikely to happen again, we…